Solutions for each step

Helping owners and dreamers by providing the business tools

and financing options they need to succeed.

So How Do We Get Started?

From Creating to Sustaining

StrongerWorks can help you get your business off the ground and running. We help you build credit without a FICO score and trust in YOU and your dream. Because EVERYONE deserves a chance to see their dreams become a reality.

.png)

STRONGERSTART: A No-Fee Business Card

No FICO reliance:

Use alternative data—bank activity, cash flow, platform transactions

Community Trust Lending:

3-5 trusted members of the lender’s community who will vouch for them and support them on this journey.

Low initial limits:

$300–$1,500; flexible payment terms.

No hidden fees:

Transparent, community-first design.

Build A

“StrongerScore”

Alternative to a normal line of credit that tracks your business needs right where you want it; in hands you can trust.

Integrate your learning into Business Tool

As you build your business, tools will be suggested to you to enable you to integrate other forms of business management through partnerships and connections. E.g. LegalZoom, Relay, and Wave.

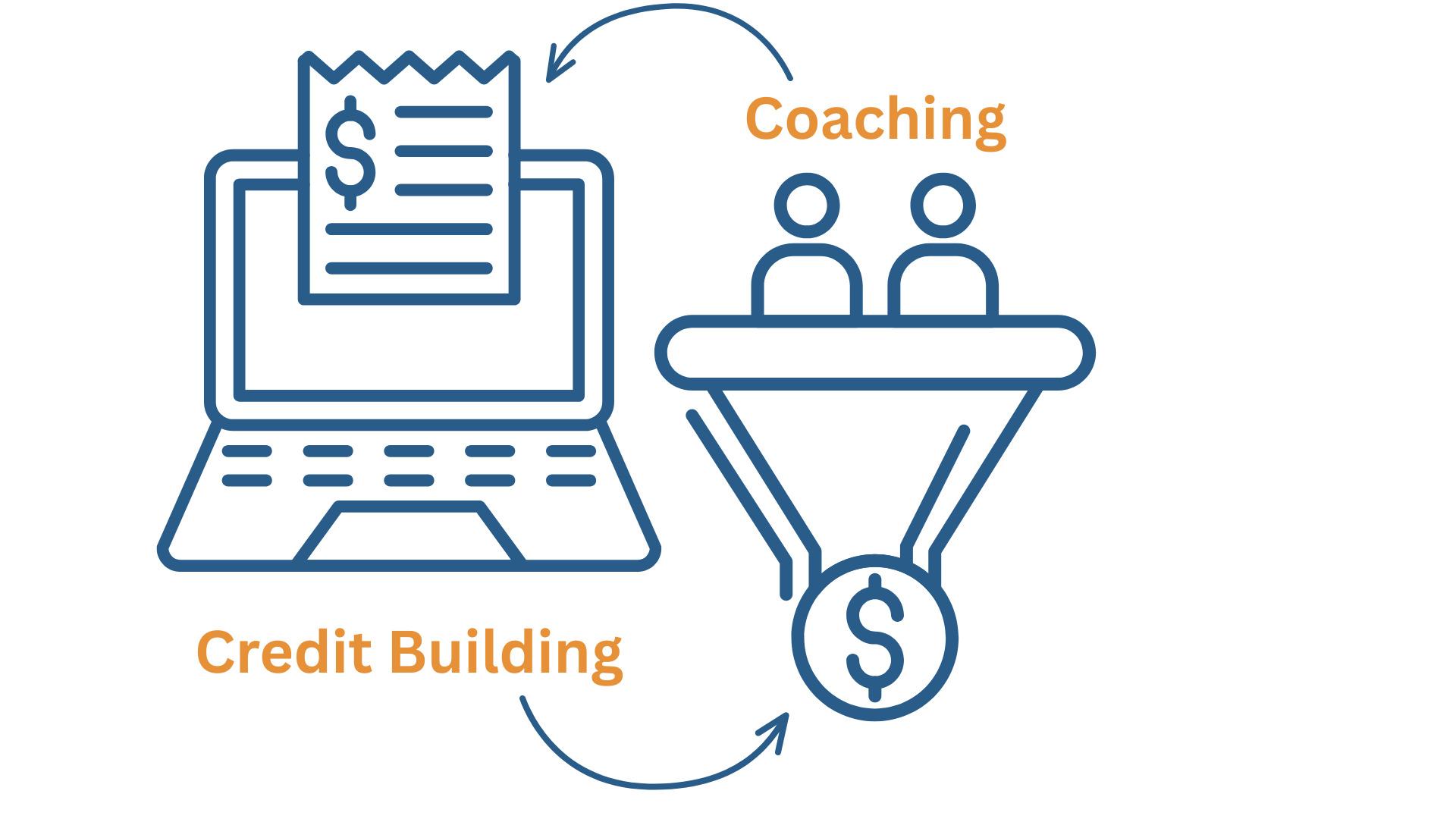

Bundle your coaching and credit building

As you start to progress in your funds and your business model you will be provided coaching on how to manage debt, plan growth, and become loan-ready.

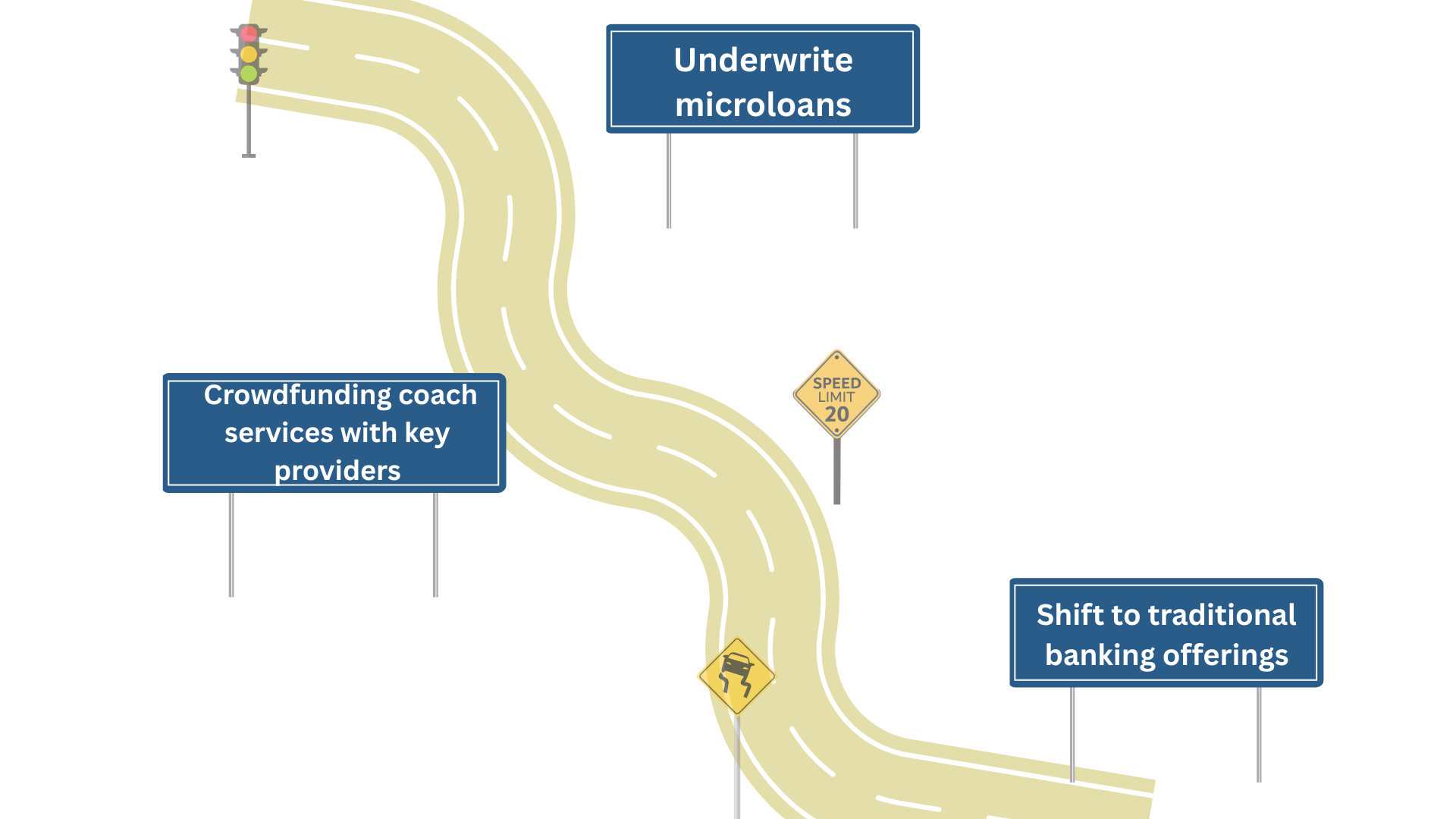

Create a Financing Roadmap

Creating a map of your goals and where you want you business to go can look like:

Card data that helps you write mico-loans.

Crowdfunding services with providers such as, Kiva and WeFunder.

Helping you shift to looking into traditional banking offers like SBA loans and Ramp.

Social Underwriting

Social underwriting is the process we use at StrongerWorks to determine whether to grant a loan. While banks and most other financial institutions use a data-driven system that relies purely on quantitative data, such as credit score, cash flow, and collateral value, social underwriting is a more personal, character-based approach. What social underwriting boils down to is this:

Your creditworthiness is determined by the strength of your character and your standing in your community.

.jpg?width=2000&height=1333&name=joshua-rodriguez-f7zm5TDOi4g-unsplash%20(1).jpg)

The number of lenders invited (and successfully converted) by the borrower, as well as the endorsements a borrower receives, are clear predictors of that individual's loan repayment rate. By focusing on these personal aspects, StrongerWorks aims to support individuals who don’t meet the criteria established by traditional financial institutions.

In this community-backed, character-based lending here at StrongerWorks, what matters is whether your community trusts you. If your community and lenders trust you and believe in your business and entrepreneurial spirit, so will we.